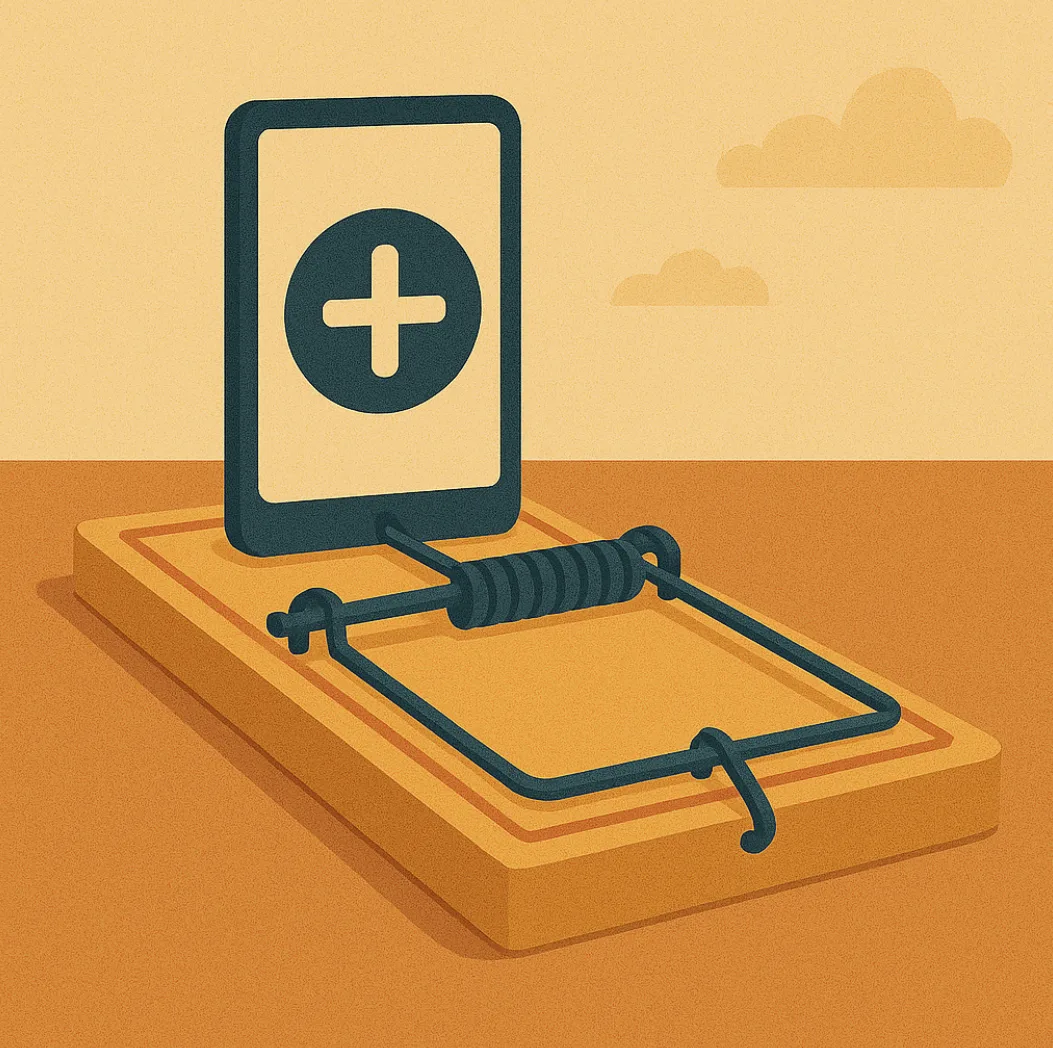

The Subscription Trap: How Small Monthly Fees Quietly Steal Your Financial Freedom

You don’t need to be rich to go broke — you just need Wi-Fi and a few “free trials.”

It starts innocently enough. A $9.99 music app here. A $12 streaming service there. A $4.99 “premium plan” you barely remember subscribing to. None of it hurts — until you realize your paycheck is bleeding to death, one friendly-looking icon at a time.

Welcome to the subscription economy: the modern version of slow financial erosion.

The Illusion of Small

Marketers discovered long ago that the human brain can’t feel small numbers. “Only $7.99 a month” feels like pocket change. “Cancel anytime” feels safe. But multiply that “only” by ten, add taxes, and suddenly your wallet is living in quiet distress.

The average American now spends over $200 a month on digital subscriptions — more than most car payments in the 1990s. And that’s not counting hidden “micro-bills”: cloud storage, fitness apps, dating apps, digital newspapers, AI tools, software licenses, VPNs, newsletters, and the ever-expanding jungle of “premium” everything.

The math is brutal: $200 a month = $2,400 a year = $24,000 per decade. That’s a house down payment disguised as Spotify, Netflix, and Adobe.

The tragedy isn’t just financial — it’s psychological. Subscription fatigue slowly normalizes leakage. You stop noticing money leaving because it’s not leaving in chunks. It’s dripping — silently, automatically, relentlessly.

Convenience Is the Hook

The subscription model isn’t evil. It’s brilliant. It’s frictionless. It’s capitalism’s most elegant trick: make consumption feel weightless.

Want to watch a movie? Don’t pay once — subscribe. Want to use Photoshop? Don’t buy it — rent it forever. Even toothbrushes, coffee pods, and underwear now come “as a service.” Everything you touch is being turned into a recurring revenue stream.

Businesses love it because it stabilizes profit. Investors love it because it guarantees growth. Consumers love it because it feels easy — until they wake up one day realizing their lives are rented, not owned.

And that’s the dark side of convenience: it erodes awareness. When everything auto-renews, you stop asking whether you still want it. You just keep paying, month after month, for the ghost of a habit you forgot.

The Psychology of Auto-Pay

The subscription trap works because it exploits your brain’s two weakest points: inertia and optimism.

You tell yourself you’ll cancel later. You believe you’ll “use it more next month.” You think $5 doesn’t matter.

But that’s the trap — it’s not the $5; it’s the hundred $5s.

Companies know this. That’s why they hide cancellation buttons behind labyrinths of “Are you sure?” pop-ups. That’s why trial periods auto-convert at midnight. They’re not counting on your excitement — they’re counting on your exhaustion.

Even worse, some apps use “subscription shaming” — little guilt messages like “We’ll miss you!” or “Your progress will be lost.” It’s digital manipulation dressed in friendliness.

The Netflix Paradox

Remember when Netflix felt revolutionary? Now everyone wants to be Netflix. Every industry. Every niche.

The irony is that the very idea that made Netflix famous — pay a small fee for access to everything — has now multiplied into chaos. You need five subscriptions to watch five shows, three to read the news, and two just to store your own photos.

Subscription overload has created choice fatigue. We’re overwhelmed by abundance, yet somehow still unsatisfied. It’s like owning every channel and still finding nothing to watch.

The problem isn’t that we’re spending too much — it’s that we’re spending without feeling it.

How to Escape the Trap

Breaking free doesn’t mean living like a digital monk. It means reclaiming agency.

Here’s the simple (but uncomfortable) process:

Audit Everything. Once a quarter, list every recurring charge. Every app, service, donation, membership. If you can’t remember signing up for it, that’s your first clue it needs to go.

Ask One Brutal Question: “Would I sign up for this today if I didn’t already have it?” If the answer’s no, cancel it.

Use the “Friction Test.” Subscriptions that make canceling difficult don’t deserve loyalty. If they respect you, they’ll make leaving as easy as joining.

Replace with Ownership. Sometimes buying outright is cheaper in the long run. A $60 lifetime license beats $10/month forever.

Create a “Re-Subscribe Ritual.” When you cancel, mark the date. If you miss the service after 30 days, re-subscribe — guilt-free. 90% of the time, you won’t.

Bonus tip: rename your “subscription” budget line as freedom tax. It reframes every payment as a choice: “Is this worth my freedom?” That mindset changes everything.

The Real Cost of Subscriptions

Beyond the money, subscriptions cost something deeper: mental bandwidth.

Every auto-renewal is one more open tab in your mind. Every “free trial” is another micro-commitment. You may think you’re buying convenience, but you’re actually renting attention.

Minimalism isn’t about cutting everything — it’s about cutting the noise. When you reduce subscriptions, you regain clarity. You remember what actually matters. And ironically, the fewer services you pay for, the more you use and appreciate them.

Ownership breeds respect. Subscriptions breed indifference.

Everything-as-a-Service

The subscription trap isn’t going away — it’s expanding. AI platforms, education, healthcare, even cars are moving toward “usage-based billing.” Soon, your fridge may charge you monthly to reorder groceries, your electric vehicle might bill you for seat heaters, and your smart home could demand an upgrade fee to “stay connected.”

In this world, awareness becomes rebellion. Knowing what you pay for — and why — becomes an act of financial resistance.

Because if everything is a subscription, then freedom is the ability to unsubscribe.

News

The Cost of Comparison: How Measuring Your Life Against Others Is Quietly Destroying Your Financial Peace

The Cost of Comparison: How Measuring Your Life Against Others Is Quietly Destroying Your Financial Peace It starts small.A friend posts a new apartment. Someone announces a promotion. Another just got engaged — or bought their first car — or launched their “dream project.” You smile, maybe even comment a congratulatory emoji. But somewhere, in […]

The Anxiety of Saving: Why We Feel Guilty Even When We’re Doing the Right Thing

The Anxiety of Saving: Why We Feel Guilty Even When We’re Doing the Right Thing You’d think saving money would feel good — empowering, smart, responsible. And sometimes, it does. But other times? It feels like guilt in disguise. You skip the dinner invitation to stay within budget — and feel cheap.You put a bonus […]

Financial FOMO: How the Fear of Missing Out Is Wrecking Your Wallet and Your Sanity

Financial FOMO: How the Fear of Missing Out Is Wrecking Your Wallet and Your Sanity You know that feeling — the one that hits right after you scroll through someone’s “just booked my Bali trip” story while you’re staring at your 3-day-old leftovers. That twitch in your brain whispering, “Maybe I should go too.” That’s […]

Quiet Luxury, Loud Debt: Why the Desire to Look Rich Is Making Us Poor

Quiet Luxury, Loud Debt: Why the Desire to Look Rich Is Making Us Poor Everyone wants to look rich. Fewer people actually are. We live in a world where the appearance of wealth is more valuable than wealth itself — a world where image is currency, lifestyle is branding, and “quiet luxury” is louder than […]

Financial Red Flags in Relationships: How to Spot Money Habits That Can Break Your Future

Financial Red Flags in Relationships: How to Spot Money Habits That Can Break Your Future Love makes us blind — but debt, dishonesty, and impulsive spending will eventually turn on the lights. Money doesn’t just fund relationships; it exposes them. It reveals values, priorities, and fears in ways even love can’t. Ask any divorce lawyer […]

The Retirement Illusion: Why ‘Working Until You’re 65’ No Longer Works (and What the Next Generation Is Doing Instead)

The Retirement Illusion: Why ‘Working Until You’re 65’ No Longer Works (and What the Next Generation Is Doing Instead) There was a time when the math made sense.You’d work for forty years, pay your mortgage, collect your pension, and spend your golden years golfing, gardening, or spoiling grandkids. Retirement was the finish line — the […]

End of content

No more pages to load

BẠN CẦN TƯ VẤN VỀ NỘI THẤT CHO NHÀ XINH? GỌI NGAY HOTLINE: 0909090909

Lưu ý: dấu (*) là bắt buộc nhập. Cảm ơn quý khách đã xem sản phẩm của chúng tôi.